Create Date: October 7, 2024

Last Modified Date: January 14, 2025

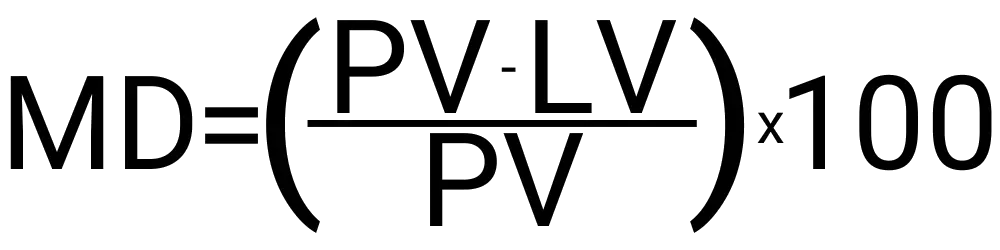

Calculating the maximum drawdown of something can be done with the following two variables:

Your result will be a percentage which represents the total percent fall the value of something saw at one point. You decide what the timeframe of your value assessment is, this tool will then tell you how much it fell during that time when it reached its lowest point from that peak value.

Calculating the maximum drawdown of something has never been easier. With our tool, you can quickly and efficiently calculate this. The steps involved include:

Let's say we want to evaluate the performance of our stock portfolio. We know we had a very good run with the market recently but then things took a rough turn before normalizing. We can use this tool to see just how far down the portfolio's value dropped. At it's peak, the portfolio was valued at $110,000. Then within our desired timeframe, the portfolio fell to a low of $72,200.

To calculate the maximum drawdown of our portfolio we will enter 110,000 into the peak value field. Then we will enter 72,200 into the lowest value after peak field. We can then hit calculate and get a maximum drawdown of -34.36%.

A good maximum drawdown is anything that is less than 50%, or depending on your specific situation. There is no single number that is good or bad but there are general guidelines to follow and try to align your results with.

Maximum drawdown can be no more than 100% since you can only lose your entire position and value. This may be untrue in very specific situations, such as one where margin is used to purchase a position and you lose the entire position and need to pay back the margin making it more than 100%.

Yes, maximum drawdown is always going to be negative since the measured value is always going to be based on a decline in value.

Absolute drawdown refers to the actual value difference, while maximum drawdown is a percentage. For example, your account peaked at 50,000 but dropped to 25,000 at one point after that. Your absolute drawdown is 25,000 and your maximum drawdown is 50%.