Create Date: July 16, 2024

Last Modified Date: January 14, 2025

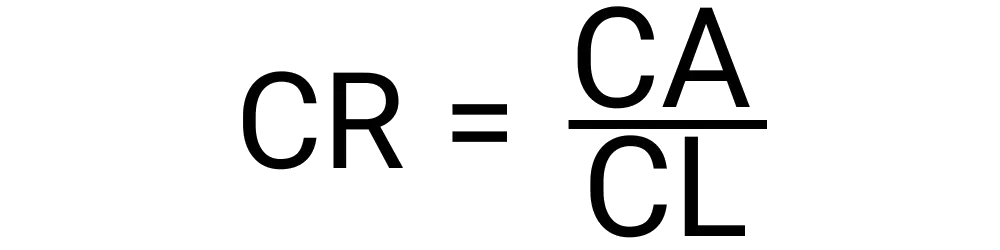

Calculating current ratio is rather simple, the variables that are required include:

With your current ratio value you can determine if you are satisfied with the current state of your assets versus your liabilities. This result is shown as a single number that will represent your assets compared to your liabilities. It is often believed that a good current ratio is somewhere between 1.2 and 2.

Current ratio can easily be calculated with this tool. The steps involved include:

Let's say you want to make sure your business is in a good financial standing by assessing your current ratio. Currently, the assets are totaled up to $450,000 and current liabilities is $125,000. Using this tool we can find the current ratio, first we will be entering 450,000 into the assets field and then 125,000 into the liabilities field.

We can now hit calculate and find that we have a current ratio of 3.6. This is considered to be above average and is a positive sign.

Having a good current ratio can be important. What is generally considered good is a current ratio between 1.5 and 3.0, so yes, a current ratio of 1.5 can be considered good.

Current ratio should not be too high, if it is higher than 4 or 5, it may be a sign that your business is holding onto too much cash or assets where you could use them to maximize profits instead. This is all dependent on your industry, business model, and other factors. It is advised that you talk to a business accountant or similar professional to learn more about your businesses' current health.

Technically, current ratio can not be negative. This is because your assets value should always be over zero, if it is below zero it is not an asset making the calculations not correct.