Create Date: September 12, 2024

Last Modified Date: January 14, 2025

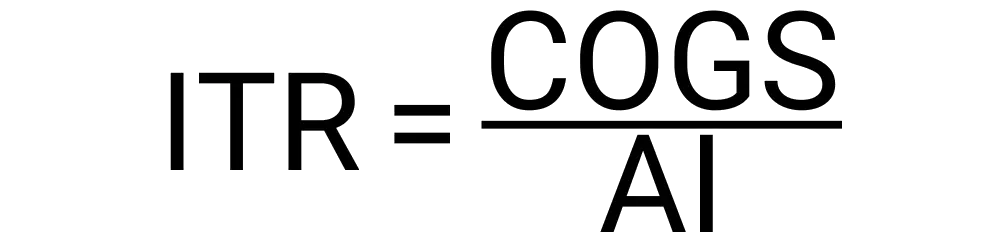

Calculating inventory rate can be done with the following variables:

Your inventory turnover rate result will be a number. This number represents how often inventory is sold and replaced over a specific period, typically a year. The higher this number is the more efficiently and quickly items are sold and replenished. If this number is on the lower-end, this means that there is slower movement and sales of products and can be a sign of a larger issue. Additionally, you will be shown your inventory days. Inventory days represents how many days, on average, it would take to sell the inventory. The higher this number is the worse it is. It would signify that it would take many days to sell out of the inventory means sales are low.

A good inventory turnover rate for businesses will depend on your specific business and operation. Often times it is generally said that a good turnover rate is between 5 and 10, meaning the inventory is sold every 1-2 months.

Calculating inventory turnover has never been more simple. With this tool you can easily find this out in a matter of minutes or less. The steps involved with using this tool includes:

We want to find out inventory turnover rate to get a better understanding of our operation and how efficiently we are moving product. We can use this tool to help us get this value. To start, we will have to enter our situation's information. We will be reviewing a year timeframe. Our COGS is $550,000, the beginning inventory amount was $1,500,000 and the ending inventory amount was $1,000,000. We can now hit calculate and get an inventory turnover rate of 0.44 and an estimated inventory days of 830.

This means that a company can sell and replace its inventory of goods five times a year.

If your turnover rate is really high, it is a good thing since your products are selling and customers are flowing, that is if your business is profitable. On the other hand, it is possible that the product is undervalued and poses as too good of a deal to pass up, meaning you may want to assess your pricing structure. Also, it means you may be more prone to product shortages if any snags in the supply line occur.