Create Date: July 15, 2024

Last Modified Date: January 22, 2025

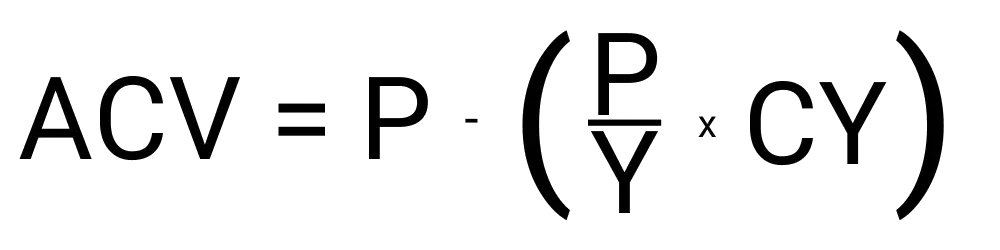

Calculating actual cash value, or ACV for short, can be done with a few variables:

Your result will be the actual cash value of an item that you are describing. This means that it is the value in the eyes of certain entities of an item. This is often used in insurance and other similar fields to assess values of items. The actual cash value ignores the going-rate of the item in the resale market or retail market, it will also never be greater than the purchase amount you entered.

Our actual cash value tool is very easy to use. The steps involved include:

Let's say you recently got into a car accident, your insurance will need to assess the worth of your car by finding its ACV. Your car was made 10 years ago and you purchased it for $10,000. Your car is given an expected life of 25 years. We can use this tool to now find the ACV by entering 10,000 into the purchase price, 25 for the life expectancy and then 10 for the current age of the item.

We can now hit calculate to get an ACV of $6,000. This means the car has depreciated in value down to $6,000 and they will now be using that number to carry on with their investigation and processing of your case. The car may be highly sought after and selling for $40,000 in the aftermarket, but it does not matter. ACV ignores other markets and is based on your purchase price solely.

The roots of actual cash value go back to the 1600s when European merchants sought to protect goods they were transporting by sea. Insurers needed a way to calculate the compensation owed to shipowners or merchants for lost or damaged cargo. This would begin to change over time.

Fast-forward to the 1700s where property insurance is becoming more popular, especially in England. But it isn't until the 1800s where fire insurance became popular and very important to businesses. Insurers then developed the concept of actual cash value to prevent overpayment for claims. It is here where ACV was defined as the replacement of the cost of an item minus depreciation.

This concept has continued to be upheld in modern day. Some policies have some minor tweaking on the way it works and what is going to be covered by plans. But actual cash value has cemented itself in the insurance industry today.

Actual cash value is often used in the insurance industry for claims about items. It is used to determine the value of an item and can ignore actual economic factors and values.

Actual cash back cannot be negative. It can be as low as zero, but it cannot be lower than that.

Understanding acreage can be difficult if some of the terms and keywords used are not ones you understand. Here we shed some more light on some of these terms.

| Term | Definition |

|---|---|

| Resale market | The resale market is the unofficial market where items are purchased or sold. The prices for goods and services differ on the resale market opposed to the retail market. |

| Expected life | The expected life is how long, typically in years, that an item is expected to be viable and usable for. |

There are many interesting things that can be shared about ACV. Here are some of our favorites.

ACV is one of the most disputed terms in insurance claims because depreciation rates are often subjective and can vary widely depending on the insurer.

A new car loses about 20-30% of its value after just the first year, making it have a significant drop in ACV in a very short period of time.

Older items that are still usable can have an actual cash value of $0 despite being usable. This is because the depreciation it experiences wipes away all value for it.