Create Date: September 9, 2024

Last Modified Date: January 14, 2025

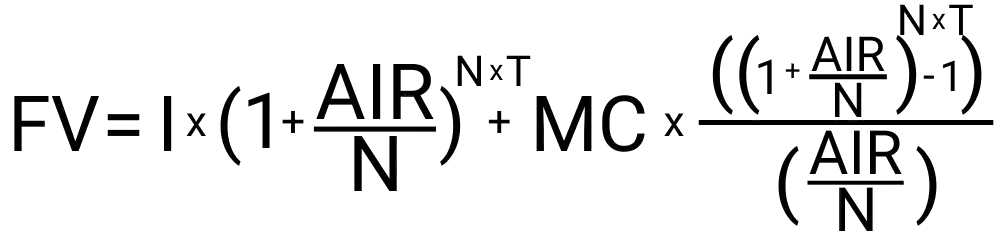

Compound interest is one of the strongest forms of interest known to man. Calculating it can be done with the following variables:

Your results will outline what the final value of your investment will be after the time has passed. It will also tell you the total amount of money that you have invested into it so you know how much of it is capital that you directly put into it and how much of it is growth of the account due to compounding interest. Keep in mind that your results may not be exact in scenarios when the rate of return that you entered is not guaranteed.

Knowing how much money you may make due to compounding interest is an important thing to understand. However, it can be very difficult to calculate that number. This tool makes it both easy and efficient to do so. The steps involved with using this tool include:

Let's say we want to open a new investment account so we can put some money away for when we retire. We have a total of $71,000 that we will be initially investing. We are expecting to get a 13% return annually and we are planning on leaving the account alone for 25 years. We will also be adding $500 to the account every month for the entire length of the account. We can use this tool to calculate how much the account will be worth at the end of the duration. After entering all of the values into the proper fields you can hit calculate. We learn that the estimated final value will be $2,922,933 and of that, we would have invested $221,000 of our own money.

Compound interest is great and is something that helps your money grow faster.

In investment terms, you cannot directly lose money due to compound interest. Compound interest will always be related to a gain in value, but it is possible for an investment account to begin to lose money, making the compound interest less effective than it once was.

You have to continually search and shop for interest rates, but some of the best assets with compound interest are CDs, HYSA (High Yield Savings Account), stocks, bonds, or IRA investment accounts.