Create Date: September 12, 2024

Last Modified Date: January 15, 2025

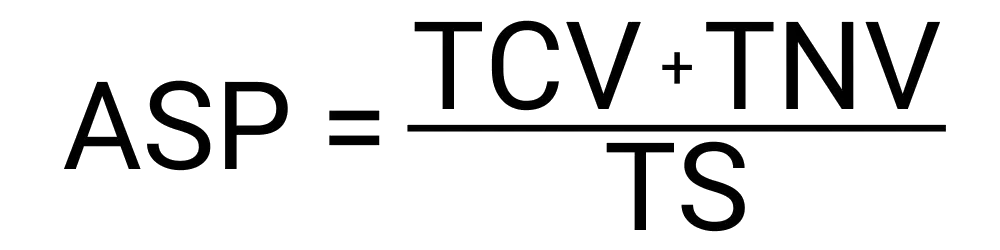

If you are trying to calculate your new possible share average, you must have the following variables:

Your results will clearly outline the new total amount of shares you have and the new average price per share of them. If you are buying shares at a higher price than your original batch of shares, then the average share price will go up, and vice versa. An important note is that this will only work as it is intended to if you are evaluating the same equity both times. Average share pricing does not work if you have shares of company A and want to buy company B shares now.

If you are trying to calculate your new share average this tool does it for you. To use the tool you have to follow the following steps:

We really like this new company that is listed on the NYSE and we want to buy more shares of it. We currently have 450 shares at a price of $5.50 per share. We want to buy 500 more shares at its current price of $4.40. We can use this tool to learn what our new price per share would be. First, we will enter our current position of 450 shares at 5.50 per share. Next, we will enter our new position of 500 shares at 4.40 per share. We can now hit calculate and get a new average price per share of $4.92 for our 950 total shares.

If you average up on a position in your portfolio, it can be both good and bad. If you have high conviction in the asset it is a good move, if not it may not be. Only time will tell how it performs.

Downside averaging is when you add to a position when you are already down on it. This can be good as it will lower your cost per share, but you are now more invested in something that is not profitable currently. You are running the risk of being exposed to more losses but will be in the profit zone sooner if it begins to go up since the average cost per share has fallen.