Create Date: September 30, 2024

Last Modified Date: February 5, 2025

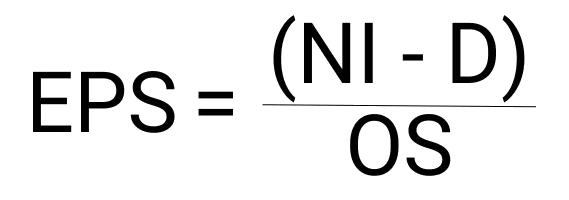

When you are calculating earnings per share you need to have the value of three variables:

When you calculate EPS you will get a dollar amount back. This is the only result and you will have to apply it correctly to your use-cases to make the most of it. As we know, EPS is a measure of how much income a company has earned per common share. If a company is doing very well, it will have an EPS that is higher rather than lower. EPS can be negative as well, this can be a clear sign that a company is not doing well and should not be invested in.

NOTE: The EPS for a company is ever-changing, you should almost always get a new earnings per share value each quarter. It is normal and expected, it would be more odd if a company always got the same EPS. This is due to ever-changing company performance, seasonality, and many other factors that can impact a business' performance.

Figuring out the EPS of a company is typically not something you have to do, but if you need to calculate it you can use our simple tool. The steps to use this tool include:

You are an eager investor, we all want to make sure we choose the right company to make the most of our money. You read their latest earnings report and notice they left out their EPS so you have to calculate it by yourself using this tool. After reading their official documents, you find they have a net income of $5.7 million, paid out a total of $1.1 million in dividends, and have a total of 24 million outstanding common shares. After plugging these numbers in our tool, you will get an EPS of $0.19!

Earnings per share is not a concept that goes back to ancient times. it is a more recent term, primarily focused on the 1900s and later. The reason it became necessary to have this type of metric is due to the growing stock exchanges and the number of assets available on them.

Corporations then began to issue more public shares. Over time, investors were unable to compare profitability between different companies due to the variations in shares. The Great Depression sparked major reforms in financial institutions and processes. In particular, the U.S. Securities Act of 1933 and Securities Exchange Act if 1934.

In addition to those acts being passed, the Securities and Exchange Commission (SEC) began to enforce standardized financial disclosures. By the 40s and 50s, financial analysts would begin to use EPS as a key measure of a company's performance.

The way EPS was reported and how it worked tweaked numerous times over the following decades. This can continue to change but is now in done so by the Generally Accepted Accounting Principles (GAAP). Investors having the most appropriate information and true transparency has changed the financial world for the better, for everyone, namely with the help of EPS.

EPS tells you the amount of money each common share of a company makes. If you have an EPS of $1.50, each share is essentially attributed to $1.50 in profit for the company.

There is no single good EPS for all stocks, this varies by industry, company age, and other factors. But it is believed that some of the best stocks have an EPS of about 75 or more.

You want an EPS as high as possible, this means it generates more money per share than not.

If EPS is too high it may drive the price up of the stock price and make it a more expensive investment which inherently adds more risk to the purchase.

Yes, EPS can be negative. If you find a company with a negative EPS it means it is losing more money than it is generating and should be generally considered as a very risky investment opportunity.

Understanding EPS can be difficult if some of the terms and keywords used are not ones you understand. Here we shed some more light on some of these terms.

| Term | Definition | |

|---|---|---|

| Earnings per share (EPS) | This is the amount of money that was generated by a company, spread across each of the shares that are outstanding and available. | |

| Dividends | Some companies offer dividends which is a payout that is given to shareholders based on the number of shares available and the amount of income and other financial metrics of the company. | |

| Net income | The total amount of money leftover for a company after all expenses are paid such as salaries, taxes, and more. |

There are many interesting things that can be shared about EPS. Here are some of our favorites.

EPS can be negative. This indicates that a company lost more money than it generated in revenue.

Amazon once had an EPS of 1 cent. In Q3 of 2016 its EPS was reported to be just $0.01 and came as a shock to many investors.

Tesla had a negative EPS for over a decade before it began to rocket in valuation and hit a high positive EPS.