Create Date: September 4, 2024

Last Modified Date: January 15, 2025

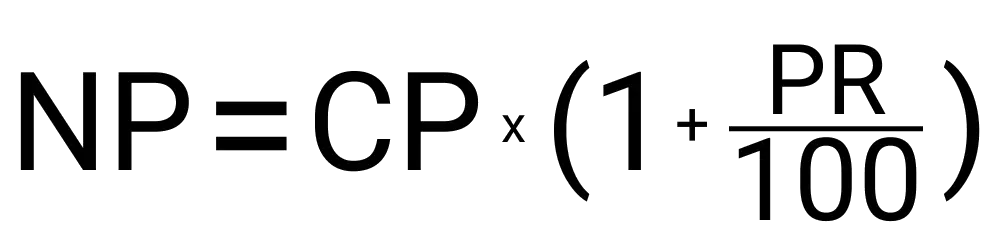

Calculating how much your new pay will be based on a certain pay raise is rather simple. The way you calculate this is dependent on the type of raise you are getting, either a percent or set dollar amount. Since a set dollar amount raise is very simple to calculate we will show you the formula for calculating a pay raise that is based on a percentage:

Your results will clearly state your new pay. It will show you both your new annual pay and your new hourly pay. Even if you are calculating just your annual pay since you are salaried, you will get the hourly value in there. We feel people often like to understand their pay in both of these manners so showing them at all times is better than not. Be mindful that our tool will not be able to calculate any type of alteration to pay. This means any potential overtime, holiday pay, night differential, or other factor is not calculated with this tool.

Being able to understand your new potential pay is important. That is why our tool is both efficient and easy to use so you can calculate it without any issues. The steps involved with using our tool includes:

We currently are working at a local data firm working in the tech department. We currently have a salary of $65,000. We were told of a new role that has opened up and if we take it we would be entitled to a 4.8% raise. We can use this tool to find out what our new pay would be with that raise. We will keep 40 as the hours worked per week, we will then leave the current pay type as annual salary. We can then enter 65,000 into the current pay field and then leave the raise type field as percent. Finally, we can enter 4.8 into the raise percentage and hit calculate to get our new salary of $68,120.

No pay raise is the same. So there is no true typical pay raise. Sometimes a situation will involve more tasks, more direct reports, relocation, and other variables. A general rule of thumb is that you would want your raise to at least compete with current rates of inflation.