Create Date: September 16, 2024

Last Modified Date: January 14, 2025

A mortgage is the name of the loan that you take out to purchase a home. These loans are typically very large and can be complex to plan around due to various factors and variables.

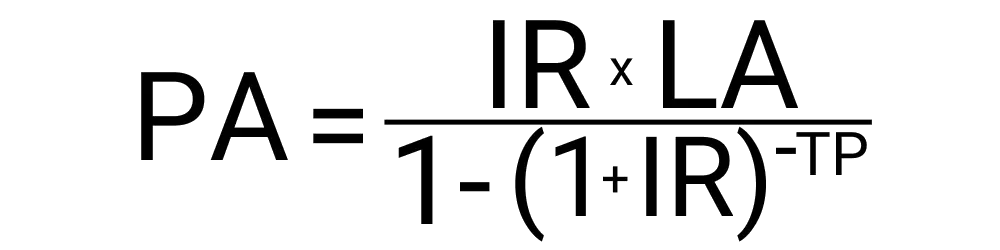

Buying a house is most likely the largest purchase you will make in your lifetime. Understanding if you will be able to afford your house is extremely important. To get an idea of what you will have to pay, you will need the following variables:

When you use this tool you will get three very important pieces of information. First, you will see your payment amount based on your selected payment frequency. This is the amount that you will have to pay towards your loan with interest applied. Then, you will get to see your total paid towards the life of the loan. This number represents the true cost of the mortgage to you as it adds the total amount of interest you will be paying during the life of the loan. Finally, you will see the total amount of interest specifically that had to be paid during the life of the loan. That number is all extra that is added on top of the house price making the true cost of buying your home much higher typically.

Understanding your mortgage and potential financial commitment is something we highly recommend you do. Our tool is designed to calculate your mortgage and clearly show you the info related to your situation. The steps involved with using our tool includes:

We are in the market for a new house and we want to do our due diligence on our next potential home to make sure we can comfortably afford it. We can use this tool to help us do that. The home we are looking at would cost $478,000 and we would be putting down $50,000. The bank is offering us a 30-year loan with an interest rate of 3.9% which we would be paying monthly. To use this tool we can enter all of those values into their correct fields and then hit calculate. When we do we learn that our monthly payment would be about $2,018.74 and our total amount paid over the life of the loan would be about $726,746 due to paying a total of $298,746 in interest.

Yes, a mortgage is a type of loan that gives the lender the right to take the property back if the borrower fails to make payments.

Yes, but only partially until the mortgage is fully paid. For example, if you have paid 50% of your mortgage, you effectively own 50% of your house.

This depends on individual circumstances. Mortgages and rent have their pros and cons, and the best choice depends on your financial goals and lifestyle.

In some cases, yes. Borrowing against your mortgage is called a home equity loan, which acts as a second mortgage.