Create Date: August 24, 2024

Last Modified Date: February 1, 2025

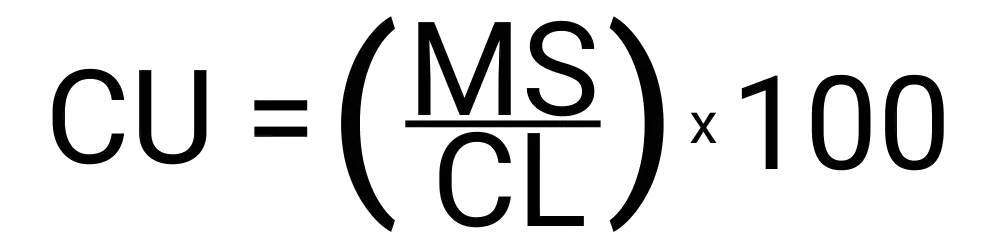

Credit utilization can be easily calculated. It only requires the two following variables:

Your result will indicate the percent amount of your credit that has been spent. This is a number that is important to track to ensure you stay under your limit by a healthy amount. A general rule of thumb is that a good credit utilization percent is under 30%, ideally under 10%.

Our credit utilization tool is very easy and simple to use. The steps involved include:

Let's say we are trying to assess our current financial situation. We want to find our credit utilization and will be using this tool to do that. We have a limit of $9,500 and have currently spent $3,250 of it so far. To use the tool we will enter 3,250 into the total money used field and then 9,500 into the total credit limit field.

We are now ready to hit calculate and get our credit utilization. We find that ours is 34.21% which is a little on the high side.

Believe it or not, credit and lending processes goes back to Mesopotamia, around 2000 BC. Back then, lenders would track debts on clay tablets. It is amazing to see how far we have come and how the credit utilization became a thing.

Closer to modern times, in the 1700 and 1800s, banks began to offer lines of credit for select clients, typically the wealthier individuals. Then the first U.S. credit reporting agency was created in 1841 by Lewis Tappan, which would later become Dun & Bradstreet.

Jumping forward again, in the mid 1900s, department stores and oil companies began to give out charge cards which allowed customers to buy on credit. There was no credit limit on these but there were hard set spending limits, making it the earliest form of credit utilization control.

The implementation of credit limits came around 1960 when companies like BankAmericard introduced revolving credit lines. These would have credit limits. This structure and terminology was then built upon in the following decades to the credit system we have today and the utilization methods we have in place now.

A standard rule of thumb is that your credit utilization should remain below 30% at all times.

It is often said that you should use at least a little bit of your credit because zero utilization is more damaging to your credit score.

While we do not provide financial advice, if you find your credit utilization around 90% then you are toeing a dangerous line and should work on lowering that number as soon as possible.

Understanding credit utilization can be difficult if some of the terms and keywords used are not ones you understand. Here we shed some more light on some of these terms.

| Term | Definition |

|---|---|

| Credit limit | The maximum amount of money that someone can have as an open balance on a credit card is their credit limit. This number is affected by numerous factors such as credit score, income, credit utilization, and more. |

| Credit history | A report that will show how well you have managed your finances including the credit utilization of your past. |

There are many interesting things that can be shared about credit utilization. Here are some of our favorites.

If you have an open balance and your credit limit increases then the credit utilization will drop instantly.

Some credit cards don't report limits which can hurt your utilization and potentially affect your credit score.

You can only achieve a perfect credit score of 850 if you have some utilization. If you have 0% utilization you will not have an 850.