Create Date: September 4, 2024

Last Modified Date: January 14, 2025

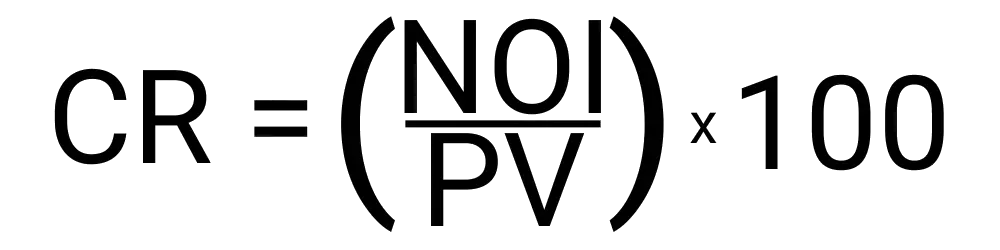

Cap rate can be calculated with the following variables:

Your cap rate will be a single percentage value that ideally will be between 5 and 10%. That is generally regarded as the ideal cap rate value which will indicate a potentially worthwhile investment based on your scenario.

Finding the cap rate of a property can be a major factor in deciding to move forward or not. We want to make the process of discovering the cap rate as easy and efficient as possible. To use this tool you must:

Let's say we are looking to buy a property that will be used as a rental property for a single family. The price tag on the house is $450,000, we have an expected annual gross income of $36,000 from rent, we have minimal operating expenses of 1.1% and expect a vacancy rate of 5%.

To get our cap rate we can use this tool to easily and quickly get our answer. After entering each value into its appropriate field, we hit calculate. We get a cap rate of 7.51% which we believe to be a very good number.

A 7.5% cap rate means the property will generate a net income of 7.5% of the property's value. If said property is worth $100,000, the cap rate would signify a net operating income of $7,500.

If all you are worried about is the return, a higher cap rate is better since it will net you more money. But what often comes with more earning potential is a larger risk, so you will have to deal with more problems and things that can go wrong. This is not how it always works but generally the higher return is the higher the risk profile is for some reasons.

The 2% cap rate rule is a general rule of thumb for real estate investors that states you should only invest in a property if it has a cap rate of at least 2%.

Cap rate and yield are similar but they are indeed different. Cap rate uses the property's value while yield uses the property's cost.

Cap rate helps an investor assess their profitability and return potential on a property. This number will be close to the profit you can expect but will not be exact.