Create Date: August 26, 2024

Last Modified Date: January 30, 2025

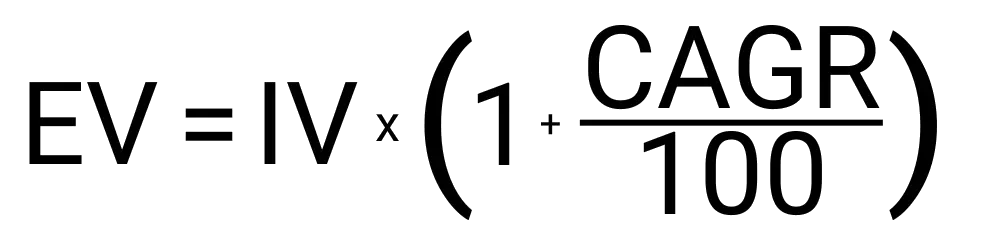

This calculator calculates the growth of something based on its CAGR, it does not calculate the CAGR based on an initial and ending value. With that cleared up, here is the formula that is used to calculate the end value of something based on its CAGR:

Ending Value = Initial Value * (1 + (CAGR / 100))Periods

If you wanted to calculate the CAGR based on a starting and ending balance, you can use this formula:

CAGR = (Ending Value / Beginning Value)(1 / No. of Periods) – 1

CAGR is often referred to as one of the best ways to accurately determine the return or growth of an investment, balance, industry, or anything that can rise or fall over time.

Our CAGR tool is very easy and simple to use, the steps include:

Let's say you want to see how much your $100,000 investment portfolio would be valued at in 5 years based on a CAGR of 7.5%. Your formula would look like this: Ending Value = 100,000 * (1 + (7.5 / 100))5. At the end of 5 years your portfolio would be valued at about $143,562.93.

CAGR can also be used to forecast the growth of an industry. For example, let's say we read a report that the tech-infused pencil market is valued at $50 million currently, and is expected to grow over the next 10 years with a CAGR of 6.7%. After plugging these values into the appropriate fields we would come to find that after 10 years the tech-infused pencil market is worth about $95,634,413.

CAGR, or compound annual growth rate, has its roots going back hundreds of years. The groundwork for CAGR was laid in the 1600s when mathematicians like John Napier and Jacob Bernoulli studied compound interest. A similar concept in the 1700s was the rule of 72. This was a shortcut to estimate how long an investment would take to double given a specific interest rate.

In the early 1900s with the growth of the stock market, investors and analysts looked for ways to smooth out volatile returns over multiple years. So CAGR-like systems were developed and used at this time.

It wasn't until the 1980s when CAGR would become an important metric that was tracked by companies. Now in the 21st century, it is used in the stock market, to gauge the size of industries, and more.

A 10% CAGR means you will get or see a 10% gain or raise in value on something every year.

A CAGR of 30% can be very good depending on the specific subject. If you are talking about an industry, that is basically an unachievable number. If you are talking about an investment account that is also rather unreachable. If you are talking about a small company, that is in line to be a good percent typically.

Yes, CAGR and annualized return are essentially the same thing, each explain and show their results differently though.

Yes, CAGR can indeed be negative. If it is, that means it is losing value which is generally not a good thing.

Understanding CAGR can be difficult if some of the terms and keywords used are not ones you understand. Here we shed some more light on some of these terms.

| Term | Definition |

|---|---|

| CAGR | Short for compound annual growth rate, this is a metric that defines the average growth a subject has experienced over a specific period of time. |

| Periods | A period refers to a specific amount of time. In this case, since the a in CAGR stands for annualized, the period is equal to years. |

There are many interesting things that can be shared about CAGR. Here are some of our favorites.

The longest CAGR study ever is 200+ years. The S&P 500 index's CAGR since 1802 is around 6.8% adjusted for inflation.

A home appreciating at 5% CAGR will double in value in about 14 years. The same can be said about investments and other types of assets.

Negative CAGR can be misleading. While a negative CAGR does indicate general decline in value there can be periods of growth that get washed away.