Create Date: September 27, 2024

Last Modified Date: January 14, 2025

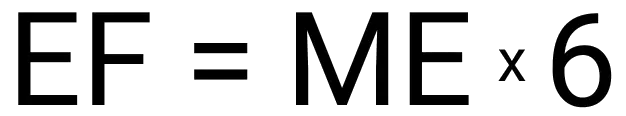

If you want to create an emergency fund you are making a great decision in your financial well-being. But being able to find out how much should be in it exactly is the hard part. If we follow the main rule of thumb where you should have 6 months worth of expenses stored away, you will do the following calculation:

It is rather straightforward, your result will be an amount of money that you should keep in your emergency fund based on your situation. It is important that you do not spend money on stuff that is not going to help you get back on the track to making more money, you need this money to hold you off until you are back on your feet. As we mentioned before, your amount is unique to your situation. Also, not every emergency fund has to be 6 months, if you prefer to have more cushion you can do 8 months, 10 months, or 12 months, whatever you can do without running your current capital flow dry.

There is no single amount of money that is good for everyone to have stored away for emergencies. One rule of thumb is that you should be able to cover your expenses for 6 months, or more, in your emergency fund. With that being said, the total amount in your emergency fund may be $15,000 or $2,500, it varies per person.

Finding out how much money should be in your emergency fund has never been easier, simply use this tool. The steps to use this tool include:

Let's say your neighbor, Jared, wants to start an emergency fund. This is a great thing to do and shows financial-maturity. He currently spends $2,560 each month to maintain all of his necessary bills to maintain his living situation. He is happy with the 6-month emergency fund, so he comes to this page and enters his monthly expenses and presses the calculate button. He finds out in seconds that his emergency fund should be $15,360 based on his situation!

This depends on your expenses and how many months worth of money you want to have saved. Some people like to keep as little as 3 months while commonly people will strive for 6 months worth saved away.

$5,000 is not a large emergency fund and will not be sufficient for most earners. If you are living with next to no expenses this can be an acceptable amount.

While an emergency fund is vital to have, having too much in it can make it limiting to live comfortably so in many cases, $30,000 may be too much. Again, the amount you should have is dependent on your financial situation.